“I wasn’t taught much to do with money, so everything I did growing up, I had to do the hard way. I had to make a lot of mistakes.“ – Gemma

Gemma knew she wasn’t in control of her money. In fact it felt like money controlled her. As a mum, she often didn’t distinguish what she “needed” from what she “wanted”. It wasn’t long before she found herself in thousands of dollars’ worth of debt.

“There was nothing meaningful out of the debt; I ended-up in a really hard time of my life where I fell into a really deep sadness.“

Gemma continued to work hard to pay the bills and debts. The stress meant she was rarely present to enjoy time with her son, Jese. Gemma realised something needed to change. Determined to have a better future, she made an inspired choice – to reach out for CAP’s FREE Debt Help to get on top of her finances.

During her journey out of debt, Gemma discovered a brand-new way of viewing money. And once she was completely debt free…

“…it took me a day to realise that I was debt free and then I was really excited! I started making goals for my future and [my career] because I didn’t have anything holding me back anymore.“

As she applied these new skills, she discovered a passion for teaching her son the money wisdom she’d never had the chance to learn. This freedom to create a better future for Jese is something she wants to share with other New Zealand parents too.

“Every mistake I’ve made, I actually taught Jessie about those mistakes. So as I’ve led by example, Jese has been able to learn from those things… [it’s] pretty cool.“

Pro tips for teaching kids about money and giving them the best start

1. Begin with the big picture: explain ‘why’ before ‘how’

Spend any time around tamariki (children), and you’ll soon recognise that ‘why?’ is one of their favourite questions. Curiosity to understand more about themselves and the world around them is part of their make-up.

So, unless you give them a satisfying answer to ‘why’ chances are they’ll never care about the ‘how’. When Jese asked “why do I have to learn the value of money?” Gemma explained:

- Money is a tool. If you use it well, you can take greater responsibility over the environment around you

- As you grow in responsibility, you can choose to be generous to people you love, and also to those who don’t have as much as you do

- If you use your money well, it gives you the ability to choose fun and rewarding things in the future

“I wanted my son to learn [money and life skills like cleaning] because I didn’t want him to rely on others to do basic needs when he’s capable of doing them himself. I want him to understand his worth. He’s grown in his character, and in the young man that he is.”

☝ Busting the myth that money equals self-worth

Sooner or later kids will encounter misleading ideas about money through school peers, social media or advertising – ideas that say ‘success’ is measured by the amount of money and popularity you have. Giving kids the big picture – that money can be a tool but it never determines your worth as a person – is an important hook on the wall that kids can hang their future learning on.

Gemma recommends spending time with your child, seeking to understand what they think about money and the world…

“I spend time sitting at the beach, talking to my son. Those conversations have taught us to become closer. They’ve opened doors that I never would’ve opened if I was still buying him all these materialistic things.”

Busting myths about money allows kids to find happiness with less, and realise the richness of your life is not determined by how much your have in your wallet.

2. Is it a need or want? Exploring the difference with your kids

“But Mum/Dad, I neeeeeed it!” Sound familiar? You probably say it yourself too – it’s such a classic! Jokes aside, it does have a ring of truth to it. To a kid, it always feels true – especially when they’re describing something they passionately want! Learning the difference between wants and needs is an important skill for growth and development.

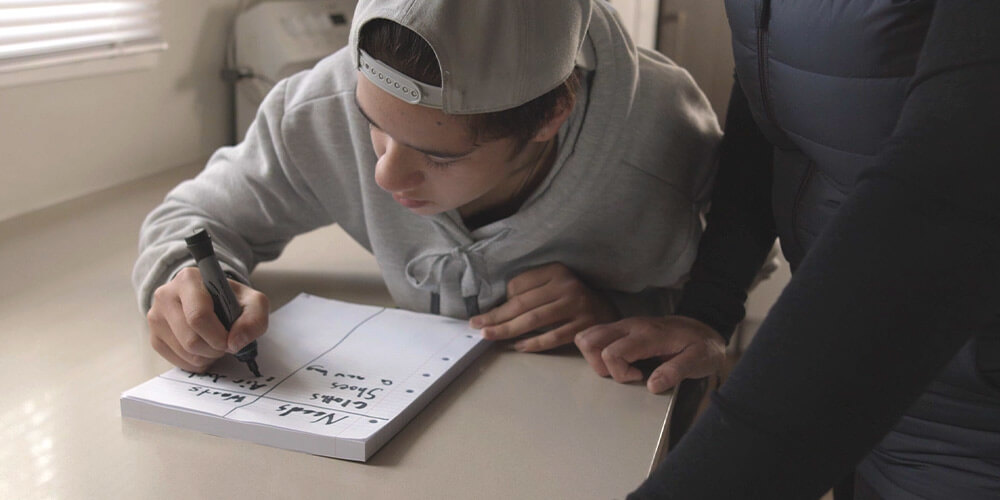

Deciding the difference doesn’t have to be boring! A fun way is to use the column exercise Gemma and Jese use in the video above. Hint: making a list of needs and wants for yourself can save you money as an adult too!

- Grab a bit of paper, draw a line down the middle of the page and pop the words ‘Need’ and ‘Want’ at the top of each section.

- Discuss how each of you would explain the words need and want. [Hint: needs are something you need to survive, such as clothes; wants are extras that are nice to have].

- Discuss a list of different things you both feel are relevant to the young person you’re teaching. Invite them to write down each item in the column that best reflects how vital it is. [Hint: the trick is to let them decide the first time around and see what they put down.]

- Have a conversation – and encourage them to edit their list as needed!

3. Teaching kids to save: a motivational, goal-based approach

“There was no meaning behind what I was buying, what I was spending my money on. I never had savings. I never even thought of savings.”

Tamariki are like sponges – they absorb our behaviours. If we’re not saving as adults, why would our kids see it at as important? Even working full time, Gemma was struggling to cover her bills. Savings felt like an impossibility. However, as soon as she started following her CAP budget and paying into her CAP Account, she immediately began saving too! While getting help from CAP, Gemma experienced the freedom and satisfaction of a saving for future expenses for the first time.

When it came to teaching Jese about saving toward goals, Gemma was keen to help him learn as early as possible:

“So when [Jese] does want those things, he does have to save for those things. He’s a bit of a scrooge with his money, but I’m happy with that!”

☝ Why setting saving goals with your kids is a must do…

If we’re honest, kids don’t often get to make a wide variety of choices. So the chance for them to choose what’s most important to them, and begin saving towards it, is an opportunity that shouldn’t be overlooked.

Allowing kids to set their own savings goals, (even if you wouldn’t prioritise the item yourself), is a key part of the learning process when teaching kids how to be good with their money. The bonus is that you’re not having to push them to put their money aside – they’ll already be motivated as they’re pulled toward the goal they’re excited about reaching!

☝ Once their saving goal is set, a visual target is vital

Just like athletes keep the finish line in sight as they run a 100-metre sprint, encourage your kids to think of a way they could visualise what they’re saving toward, too. Perhaps they could draw it on a bit of paper or find an image on the computer and stick it on a mirror, the back of a door, or a fridge. They could even stick a picture of their savings goal on their savings jar or money tin!

☝ Benefits of saving for kids – from savings to stewardship

Regardless of how kids choose to visualise their goal, allowing them to take ownership has some distinct benefits:

- Being empowered to make their own choices about the money they spend is a great step on the road to taking greater responsibility and gaining interdependence – even if it means they have to learn some things the hard way.

- When kids reach their goals, they’ll experience satisfaction and ownership.

- Most importantly, they’ll learn about stewardship and taking care of their belongings. If they’ve saved long and hard, there’s no way they’ll be taking it for granted.

These are all positive life skills that will set tamariki up for many years to come.

4. Is it good to give pocket money to your kids? A chance to earn, learn and contribute

You’ve painted the big picture, explored the difference between needs and wants and empowered your child to set their personal savings goal. Now it’s time to put this learning into action!

“You go to school [and] it’s a new season in a child’s life. The first day he turned five, I was like ‘OK I’m going to teach you how to clean your room and make your bed.”

When it comes to pocket money, there are several approaches parents take, depending on their family values:

- Some parents suggest a set amount of pocket money each week, which can be earned by completing a set number of jobs.

- Others suggest only paying kids for jobs that are over and above chores they are already expected to do each week.

The important thing is consistency; both in the base amount you give them, and what your expectations are each week. Consistency will build their trust in you – and in the process you’re taking them on – and ensures their savings goal remains achievable and motivational.

☝ Overall, pocket money offers two great benefits (both for you and your kids):

👉 1. A chance to earn

Do you remember a time in your youth when you worked hard, and bought something from the fruits of your labour? Few things are as satisfying as paying for something you’ve put the hard work in for. It’s this kind of moment that you can empower your kids to make possible!

“I wanted him to work for the things that he wanted because then he would know how to value what he has and the things that he has.“

In addition to downloading and printing out the free pocket money chart for kids to track their chores and earning each week, paying their pocket money in cash is also a great visual tool.

While it might seem old-school, handling cash means money is not an abstract number on a screen. Instead it becomes a touchable reality that they’ve worked hard to hold in their hands. This is important preparation for the world they’re growing up in.

It’s so easy in our climate of digital money, EFTPOS and online banking to think that money is make-believe and we can get more of just by wishing it so…. Later in life, as Gemma found, this can lead to young people being sucked into spin cycle of credit cards and loans.

Paying pocket money in physical cash means kids can see and count their savings as it grows in their money tin… and they learn to avoid the future snares of unmanageable debt.

👉 2. A chance to learn about what it takes to run your home

Sometimes kids simply don’t know how to help out around the house because they don’t yet know what there is to be done.

Earning money through chores not only means they can earn some hard-earned coin, it also provides an opportunity to learn healthy life skills.

“The way that he worked for his money was to do chores around the house. I taught him how to clean from a very young age, doing dishes, folding his washing, putting them away properly.”

It’s important your child knows they have a part to play in the family unit, even if their motivation for doing chores is what they’ll get out of it.

“I want Jese to know he doesn’t have to be paid to help out, but it’s respectable to help out. Even just simple things. I would put in a little bit of money without telling him the reasoning behind it. And he’d be like, “Oh, you gave me more. You gave me more money.” I would explain it to him. “I gave you more money because you offered to come and help me.” And let him know that I appreciated all this work that he is doing.”

Simple acts like folding the laundry or setting the table will open their eyes to the multitude of everyday jobs that go into running a whare or home. Over time kids develop an understanding and appreciation for what it takes to create a healthy, happy home.

While children may not admit it, being taught a new skill around the house is a satisfying experience – it provides them a sense that they have a way to contribute as part of a whānau.

Final tip as you’re teaching kids about money: Affirm who they are already, and who they can become.

Sometimes tamariki can think the reason they’re being taught something is because they’re not good at it. (But how can kids be bad at something they’ve never been taught?)

Explain you’re teaching them because you believe in them, and because you feel they’re ready to make some decisions for themselves. This will be hugely affirming for who they are already – and the amazing young person they’re becoming.

Who wouldn’t want to hear that from someone?

Understanding the value of money is a priceless gift that Gemma didn’t receive growing up… but she’s making sure it’s passed on to Jese:

“I think my son’s amazing!”

We agree!