When it comes to saving money, many New Zealanders struggle – even those with full-time jobs.

Often it’s the unexpected expenses, which make saving so difficult. Friends or family might ask you to go out, or to contribute to an activity, but there’s nothing left after paying your bills. You want to reach your money saving goals, and you don’t want the embarrassment of having to say “no” all the time – and the last thing you want is to take out further debt… So, what do you do?

Sandra had a full-time job in early childhood education but still, she had next-to-nothing left over after paying her bills. She found herself unable to save any money and being sucked into taking out overdrafts and credit cards.

Despite working hard, Sandra recalls that she never looked forward to payday.

Her story changed when she reached out for free help from Christians Against Poverty. The CAP team visited her in the privacy of her home and took a look at her situation, including her income, bills, debt and living costs.

From that point, Sandra became a pro at cutting costs, allowing her to repay debt through her CAP Account, as well as save money. After three years of hard work, always with the support of the CAP team behind her, Sandra is completely debt-free and in control of her finances.

“I don’t owe anybody anything. I can have a peaceful sleep and if I want to go buy myself a pair of shoes, I actually can! It makes me feel amazing.”

The three easy steps Sandra followed to cut costs and save money

Step 1: Do it cheaper

Doing things cheaper doesn’t necessarily mean changing your lifestyle, it just means doing the same things, on a budget. For example:

- Get the cheapest utilities such as phone, gas and electricity, and internet. Ask providers if they can beat the deal you’re currently getting, then go back to your provider to see if they’ll beat that to keep you. And you can check powerswitch to find the cheapest electricity provider.

- ‘Brand down’ when shopping at the supermarket – start buying the budget items on the bottom shelves rather than the “popular brand” items.

- Keep an eye on petrol prices and stop at the cheapest petrol station to save money. Try the phone app called Gaspy that allows you see updated petrol prices in nearby locations.

- If your budget allows it, buy essentials in bulk when they’re on sale. This may be a higher initial cost but will save you money in the long run.

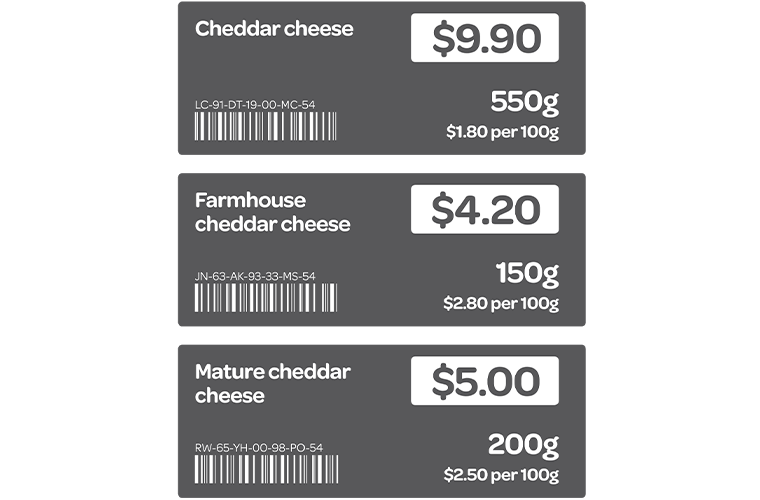

- Compare prices by looking at labels on supermarket shelves – and choose the cheapest! Most supermarkets display a small label beside the shelf pricing to show the true cost for each item, or by weight. For example, “45 cents per egg” or “28 cents per 100 grams”.

Look at the examples below. Which one represents the best value for money?

Step 2: Cut back costs

Cutting back is doing less of something. For example:

- Running a car can be expensive. Why not see if you can carpool to work, or walk or cycle for shorter journeys? As a bonus, walking or cycling is also great for your physical and mental health! You could even trade your current car for one that is cheaper to run.

- If you love eating out or takeaways, why not cut back rather than cutting out completely? Better yet, find the recipes online and make them at home for yourself!

One couple who took the FREE CAP Money course saved around $200 a month on takeaways by just cutting back – and another client saved $60 a week by taking his lunch to work.

- Love a new outfit? Cut costs by hunting for one-of-a-kind pieces at the second hand store or host a “clothes-swap” event with friends.

- Cutting costs doesn’t mean you have to sacrifice quality time with people you love. CAP suggests writing down your favourite things to do with family or friends – then brainstorm some creative, cheaper alternatives. For example, instead of paying for holiday accommodation, go for a day-trip to the bush, or borrow some gear and go camping! Check this blog post for tips on how to find happiness from things that cost nothing.

Step 3: Cut out costs

Cutting out means stopping or not doing something at all. This is where you can save the most money. A good way to begin is by listing your ‘needs’ and ‘wants’, and then start by cutting out any ‘wants’. Sandra says:

“Keep track [of your spending] just for a week even and then reflect on what you’re spending on. I would keep my receipts and look back and say ‘did I really need those things… or am I just throwing money away?”

Examples of cutting out costs include:

- Cancelling video streaming services for a period of time. You might find that reading or playing board games can be more restful, interactive and fun!

- Removing or restricting apps or games on your phone that ask for your credit card. Apps that initially appear “free” often contain in-app purchases that enable you to buy extra credits or access extra features. These apps can end-up costing you a lot of money, especially if, for example, it’s a “sticky” addictive game.

- If you have a costly habit, such as gambling or eating junk food this could be a great opportunity to quit and form healthier, cheaper habits! Using a visual aide such as a wall chart is a great way to do this!

The habit that Sandra wanted to give up was smoking cigarettes. “I thought ‘did I have money to buy cigarettes with my food money?’ ”

She quit by visually putting that money towards a goal instead. “I got a jam jar and I stuck a little wooden airplane on it. To me it [represented] my plane ticket to [visit my daughter]. It was hard! Every time I thought awww… I’m not going to buy a packet of cigarettes [and instead] I physically put $25 in the jar. And after a while it was like ‘woah, look at that! There’s actually money there!”

Bonus CAP tip: how to say “no” well to friends and whānau

You want to save money, but when it comes to activities with friends and family, “cutting back” can feel embarrassing. It needn’t be! Healthy relationships require good communication. And the great news is that there is a technique to say “no” without taking a backwards step in your relationships.

- Start by showing your appreciation that they thought about you. This will help the other person feel valued, even though you have to turn down their request. For example:

“Thank you for thinking of me, but…”;

“It sounds like a great idea, but…”

“I’m glad I can often help out, but…”

- Be direct. Say ‘no’, but in a tone-of-voice and with body language that are friendly and confident. Add an apology. For example: ‘No, I’m sorry that I can’t.’

- Give a reason. Say “no”, but explain why you’re saying it. For example: ‘No, sorry, that’s not in my budget at the moment.’

- Make an alternative suggestion. Say no, but end by giving another option. For example: ‘No, sorry, I can’t afford to do that right now, but how about we go for a walk in the park instead?’

- A further tip from Sandra is to articulate your goals to friends and family so that they can support you. “For example with smoking, tell your friends that you are stopping. [So] when you are socialising with your friends, they can support you and say ‘yay look at you!’”

Since reaching out to Christians Against Poverty for FREE Debt Help, Sandra has gone from surviving to thriving. She has learnt how to save money and is no longer “hounded” by creditors who want payment for overdue bills. She says “I’m debt free. It’s so surreal for me… it’s like “Oh my gosh, I don’t owe anybody anything and I can have a peaceful sleep.”

Now that cutting costs has become a pattern, Sandra is able to save money for things that give her life. Better yet, she is able to do what she is most passionate about, which is to be generous to others!

“It makes me feel totally empowered… Now I can if I want to do something nice for someone I can. This very friend that always used to invite me [and I always had to say no…] – now I’m in a position to call her and say ‘OK. What can I do? Would you like a carrot cake or chocolate cake?’ And I baked her a cake. For her it was so meaningful… It’s those little things that for me mean a lot.”

Finally, if your debt and bills feel overwhelming for you, Sandra shares her advice from her journey:

“There is somebody out there who can help you and the first step is being brave enough to make that call. From the bottom of my heart I am so grateful for having hooked up with Christians Against Poverty. And there isn’t a day that goes by when I have the opportunity that I don’t talk about [CAP]. I send CAP’s phone number to my friends.”