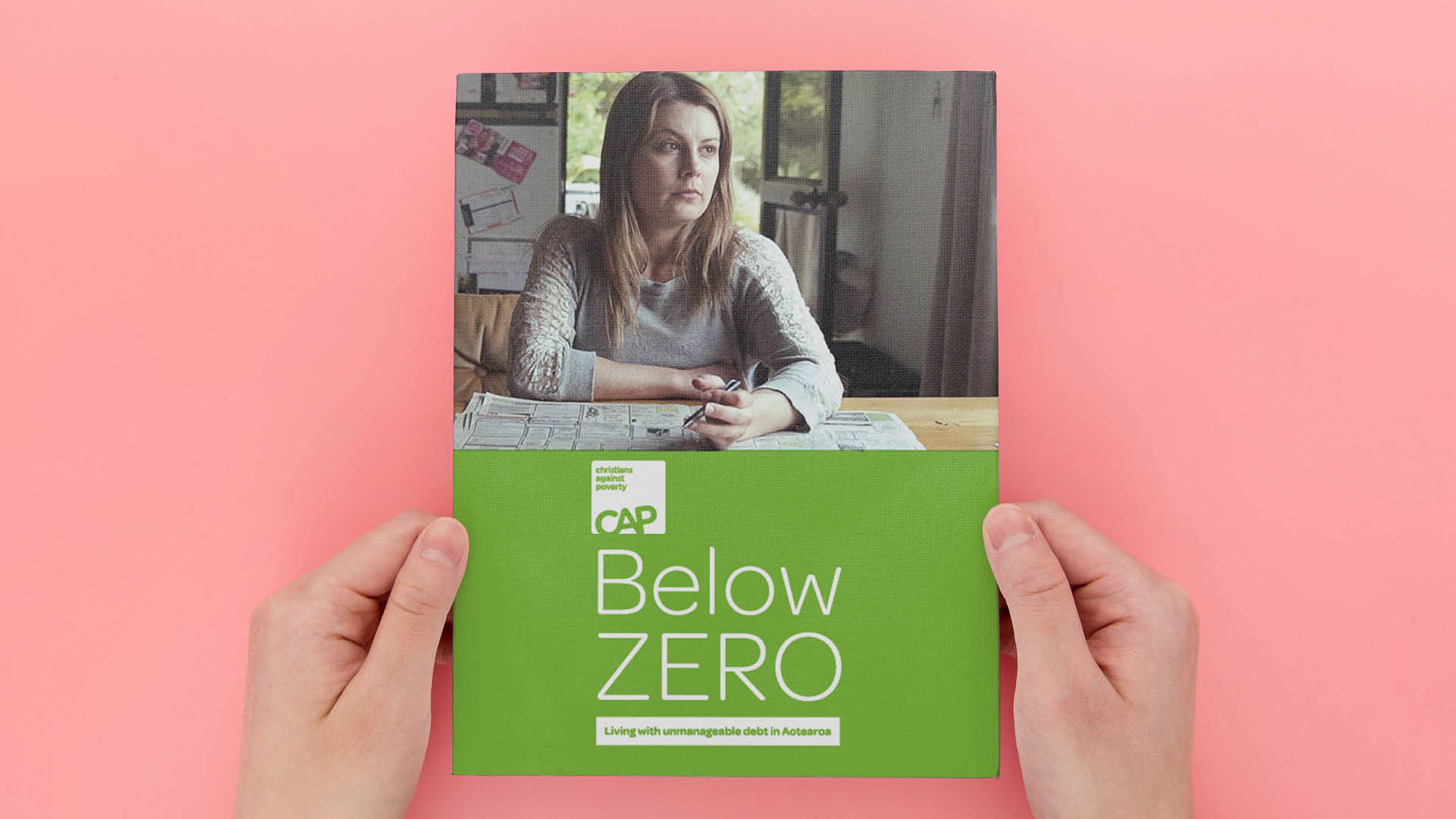

Every month, CAP receives hundreds of phone calls from people who are drowning in unmanageable debt. They feel anxious, stressed out and overwhelmed. Debt consumes more than they have to give and families are forced to live on less than zero.

The impact of being in unmanageable debt crushes families, causing despair and depression. Growing debt keeps families trapped in a cycle of financial and material hardship where parents are forced to sacrifice essential living costs to pay their debts. They experience a snowball effect, which quickly becomes an inescapable cycle.

This report looks into the circumstances of people in unmanageable debt when they first come to CAP for help. It also shares a client’s journey out of debt and on to financial capability.

The need for financial capability, however, is only half the solution. This report explores some of the many barriers families face before they will even contemplate reaching out for help. It also demonstrates the importance of non-judgmental love and acceptance, and community support to help people navigate through the many complex contributing factors in their lives.

The report concludes with three case studies of CAP clients who have become debt-free and financially capable. Each of their circumstances while living below zero is quite different – but their transition from shame and fear to confidence and hope unites them.