Is it a good idea to take a personal loan?

When the pressure’s on and you’re short of cash, taking out personal loans can seem like the best – or even the only – way to go.

Money lenders make it simple… and the cash can be in your account the same day. But fast cash is often a fast road to ruin.

Sia, a mother of six, knows what it is like for debt, bills and credit cards to spiral out of control – and what that meant for providing for her family:

Sia can relate to many New Zealanders who are struggling to survive in these difficult times. It was common for her to use debt and personal loans to pay for basic items.

“I would feel like I would tackle a bill, and then another bill would pop-up. It was like I was going around in circles, like a merry-go-round. I didn’t know how to get out of it. I hated it. I wondered: is this it? Is this life?”

After living for years in unmanageable debt, Sia decided to reach out to CAP’s free Debt Help service. While she was with CAP, Sia learned vital money management principles, and that saying “no thanks” to loans is the best option – because taking out more debt only makes matters worse.

She recalls an experience where a salesperson was trying to rush her into a purchase and to get her to sign-up for in-store finance. “[The sales person] tried to speed up the process of giving me money. And because she did it twice, I woke up and thought… what am I doing? I’ve got a roof over my head. I have gas in my tank and food. I don’t need that money.” Before walking out of the store, Sia said:

“No, sorry… I actually don’t need that money. I don’t want to get a loan.”

7 down-sides of taking on more debt with a personal loan

👎 1. Car loans, in-store finance and personal loans are ‘bad news’ because you end up paying significantly more for the item than it’s worth.

👎 2. If your interest rate is less than 50% there is no upper limit on how much you may end up paying for the item!

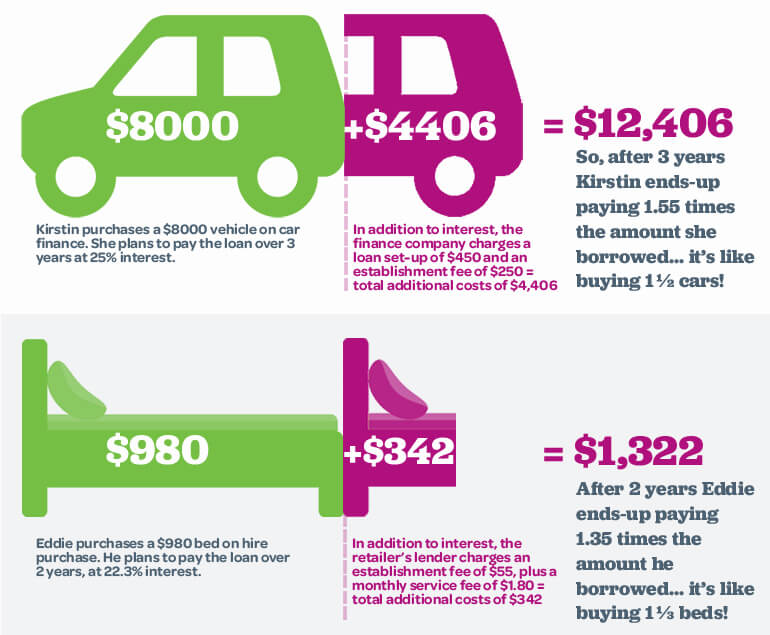

Here are some examples that Christians Against Poverty sees every day. Would you pay $12,406 for a $8,000 car? Would you pay $1,322 for a $980 bed?

👎 3. Even if you make your payments on time, most finance companies will still charge establishment and admin fees.

👎 4. High cost loans (classified as loans with more than 50% interest per year) are not just the stuff of nightmares… they’re legal in New Zealand!

NZ law allows lenders to charge interest rates up to 0.8% per day – this is the same as 292% per year! By law, these high cost lenders who are charging more than 50% interest are unable to charge more than twice the value of the original loan. However a $500 personal loan could quickly cost you up to $1000 if you failed to make repayments on time and ended-up incurring default fees.

👎 5. Taking out personal loans to tackle debt today makes it harder to pay for essential items the following week. Not only will you have to pay for next week’s essential items – you’ll also have to pay back the principle of the debt, plus interest!

👎 6. The truth about credit scores: every time you apply for a loan (whether or not it is accepted) you will actually reduce your credit score. If you’re worried about your credit score at all, this is a sign that additional loans are a bad idea.

👎 7. The more loans you take out, the harder it is to manage repayments – and the easier it is for debt to spiral out of control.

Are debt consolidation loans a good idea?

What is a debt consolidation loan?

You may have heard of something called a debt consolidation loan. This is where all your debts are taken and reduced to one “simple-to-manage” monthly payment.

Should I get a consolidation loan?

WARNING: Though there may be benefits to use these for some people, you must be aware that a consolidation loan may cost you more in the long-term. Debt Consolidation loans could be secured against an asset, such as a car, which could result in the loss of that asset if there is non-payment.

Tackling debt a better way

If you’re thinking about a debt consolidation loan the best option would be to come straight to CAP. CAP’s Debt Help service is FREE and can give you a better plan. Rather than taking on more debt, which can make the situation worse, CAP will negotiate affordable payments with each of your creditors. We’ll even do our best to stop unfair interest charges, meaning you might have less to pay-off in the long run!

Sia’s tips to go from surviving to thriving

Slow down – Don’t let a salesperson push you into a decision.

Ask yourself – “Is this a need, or a want? Do I really need this?”

Save first – If it’s a want, say “no thanks” to the loan and save the money first.

Pro tips from CAP

☝ Explore alternatives

If you decide you really need the item, explore all the alternatives before taking on debt. For example:

- Think of ways you could cut costs so you could save up and buy the item with cash.

- Look at ways that you could increase your income.

- Get your money sorted by taking a FREE CAP Money course. Here you will learn to budget, spend and save to reach your goals. Creating a budget is a way of getting control of your money, rather than money controlling you. Budget is not about saying “no”; it’s a way to give you control over what you say “yes” to.

- If you genuinely need the item (eg. for funeral costs, car maintenance, food or rent arrears), check out Work and Income who may be able to assist you.

☝ Ask questions

If you exhaust all your options and you still decide to take out a loan, make sure you ask the lender up-front:

- “How much am I going to have to repay in total?”

- “What will I have to pay if I fall behind on my repayments? ie. What are the default penalty fees, and what interest rates will be applied to the penalty?”

☝ Read the fine print

Many borrowers fall into a trap of only looking at what they’re repaying each week. It’s important that you read the small print on the contract. The fine print will show what you’re expected to repay across the entire lifetime of the loan. Once you see that your $980 purchase is going to end up costing you $1,322, you may just change your mind!

☝ Get help

Still struggling with overwhelming debt? CAP offers FREE and confidential debt counselling and long-term support. You don’t need to leave home – we’ll come to you!

A better alternative to a personal and debt consolidation loan

Sia is one of over 1,950 New Zealanders who called CAP for free help while in hardship… and who is now debt free!

“When I was with CAP, it felt like I had support. I had people that had my back, who believed in me. And it made the process so much easier. I didn’t like having a budget, but I knew that what I was doing never worked, so I was willing to give it a go. And it actually worked out.”

The CAP team negotiated with Sia’s creditors and created a liveable budget. Straight away, essential costs such as food and rent were no longer a worry. Sia was set up with a fair repayment plan, allowing her to pay back her loans using her own income. The CAP team supported Sia for three and a half years, until she became completely debt free!

Sia now wants to ensure that she shares her newfound money wisdom with her children:

“I feel like I am teaching [my children] better money principles. I just hope that what I’ve learned, they will be able to pick it up and do it for their families.”