Speaking with a partner or spouse about money and debt can seem tricky, especially if it’s been a point of tension in the past.

Former CAP Debt Help client Mark, recalls that his dire financial situation was “snowballing”. It almost forced the break-up of his marriage. Looking back, he now acknowledges that the best way to talk to your partner about money and debt is calmly, and to be “open and honest” about your situation.

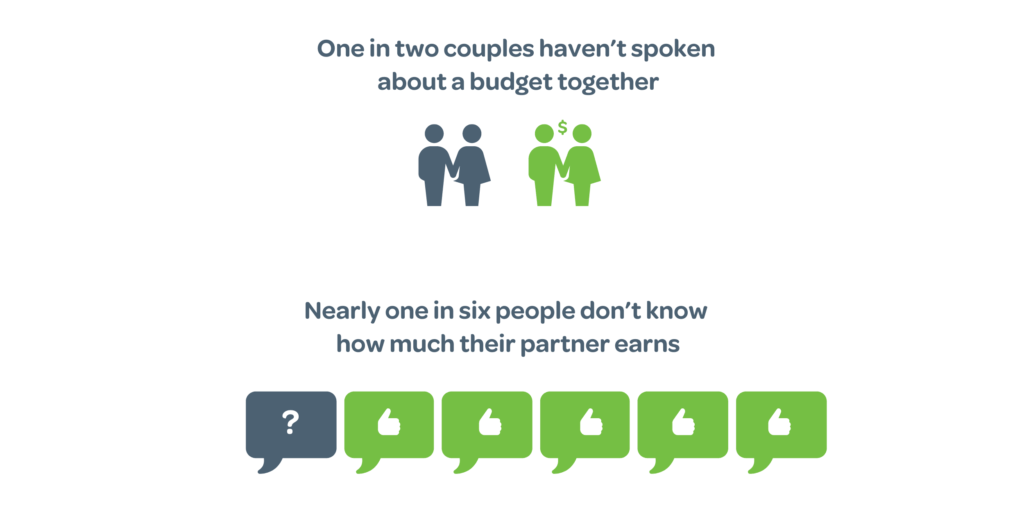

If you feel in the dark about your relationship when it comes to money, you’re not alone! The Commission for Financial Capability NZ found that…

When couples don’t talk about money it can lead to problems in other areas of relationships. It’s a bit like flying a plane. Imagine flying a plane without first agreeing on a destination and without knowing how much fuel is in the tank… Flying and hoping for the best is not exactly the best formula for getting places!

Talking openly about money can improve the dynamic in your relationship

Setting future goals (your destination) and coming up with a plan to get there (your fuel) will put you in control of the plane you’re flying – and make you better co-pilots!

Mark and Carol we were having constant arguments about money before getting help from CAP. Each and every day, creditors were calling Mark, demanding payments on overdue loans. But things turned around when CAP created their first budget, which prioritised the family’s essentials. From that day, there was no more arguing about money.

“We thought wow! It’s quite amazing to see how you’ve got money for this and this… and if you cut back you can afford this. And everything just made sense.”

So, what should you discuss as a couple?

The two main things are:

1. Agreeing on goals you’d like to set together. Your goals may be how to get through this season, or they may be longer-term, like saving for retirement or a holiday. Both short-term and long-term goals are valuable places to start, and it’s OK if you’re not thinking long-term right now.

2. Agreeing how you’re going to achieve those goals is the next step. This includes coming up with a plan or budget, including how much you want to spend on living expenses. Attending a FREE CAP Money course is a great way to do this.

Here’s a checklist to help you prepare for talking about money with your partner:

✅ When to talk to your partner about debt

If your partner is the type who appreciates a heads-up, make sure you let them know you’d like to chat later. That will allow them to clear space in their day.

✅ Where to talk

It’s best to find an area where you won’t be disturbed. It might be helpful to stay at home in a space that is free of distractions. Alternatively, go out somewhere. Try going for a walk and finding a park

✅ How to break the ice

Here are some easy ways to kickstart the conversation about debt and money with your partner:

- “We know lots of people are experiencing changes right now, could it help us to talk about our money?”

- “When you think about our family finances, what is important to you right now?”

- “Where are we headed: What are our goals for the short term (1-3 years), medium term (4-9) and long term (10 years plus)? What would we most like to see happen?”

✅ How to talk

As Mark said earlier, it pays to be compassionate and gentle. Be sure to communicate that this isn’t about blame, it’s about making a plan together.

The calmer you are, the calmer your partner is likely to be. Staying composed means you will both be able to think logically and problem-solve together. On the flipside, the more stressed or anxious you are the more likely your partner is to mirror that feeling. This could result in them becoming closed-off or defensive.

It’s important to remind each other that this is going to take effort and compromise from both of you. Getting on the same page about finances doesn’t necessarily happen in one sitting. Each person will bring different attitudes about money/finances to relationships, and getting on the same page may take time.

Talking about money is now a regular pattern for Mark and Carol. As a result of this co-operation Mark and Carol have gone from surviving to thriving – they are among over 1,950 New Zealanders who have reached out to CAP for free Debt Help and are now debt free.

“My future is so much brighter. Our marriage has gone from strength-to-strength! There’s no greater feeling on earth than saying YES to your kids now.”

And finally, if after speaking to your partner about money, you find that you are still over your head and worried about unmanageable debt, give CAP a call. Similarly, if you are struggling to deal with a partner in debt, don’t hesitate to get in touch.

Mark says that reaching out for free help from CAP made “all the difference”.

“I felt like I was in this massive hole and I was trying to get out, and then by calling CAP there’s this ladder coming over the hole coming down to meet me. It was relieving; somebody was on our side, somebody had our backs and there was no need to be afraid anymore.”